Note

This page was generated from docs/tutorials/04_european_put_option_pricing.ipynb.

Pricing European Put Options#

Introduction#

Suppose a European put option with strike price \(K\) and an underlying asset whose spot price at maturity \(S_T\) follows a given random distribution. The corresponding payoff function is defined as:

In the following, a quantum algorithm based on amplitude estimation is used to estimate the expected payoff, i.e., the fair price before discounting, for the option:

as well as the corresponding \(\Delta\), i.e., the derivative of the option price with respect to the spot price, defined as:

The approximation of the objective function and a general introduction to option pricing and risk analysis on quantum computers are given in the following papers:

[1]:

import matplotlib.pyplot as plt

%matplotlib inline

import numpy as np

from qiskit_algorithms import IterativeAmplitudeEstimation, EstimationProblem

from qiskit.circuit.library import LinearAmplitudeFunction

from qiskit_aer.primitives import Sampler

from qiskit_finance.circuit.library import LogNormalDistribution

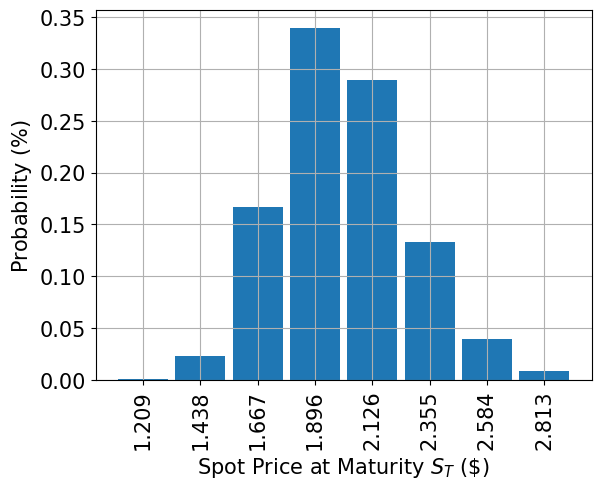

Uncertainty Model#

We construct a circuit to load a log-normal random distribution into a quantum state. The distribution is truncated to a given interval \([\text{low}, \text{high}]\) and discretized using \(2^n\) grid points, where \(n\) denotes the number of qubits used. The unitary operator corresponding to the circuit implements the following:

where \(p_i\) denote the probabilities corresponding to the truncated and discretized distribution and where \(i\) is mapped to the right interval using the affine map:

[2]:

# number of qubits to represent the uncertainty

num_uncertainty_qubits = 3

# parameters for considered random distribution

S = 2.0 # initial spot price

vol = 0.4 # volatility of 40%

r = 0.05 # annual interest rate of 4%

T = 40 / 365 # 40 days to maturity

# resulting parameters for log-normal distribution

mu = (r - 0.5 * vol**2) * T + np.log(S)

sigma = vol * np.sqrt(T)

mean = np.exp(mu + sigma**2 / 2)

variance = (np.exp(sigma**2) - 1) * np.exp(2 * mu + sigma**2)

stddev = np.sqrt(variance)

# lowest and highest value considered for the spot price; in between, an equidistant discretization is considered.

low = np.maximum(0, mean - 3 * stddev)

high = mean + 3 * stddev

# construct A operator for QAE for the payoff function by

# composing the uncertainty model and the objective

uncertainty_model = LogNormalDistribution(

num_uncertainty_qubits, mu=mu, sigma=sigma**2, bounds=(low, high)

)

[3]:

# plot probability distribution

x = uncertainty_model.values

y = uncertainty_model.probabilities

plt.bar(x, y, width=0.2)

plt.xticks(x, size=15, rotation=90)

plt.yticks(size=15)

plt.grid()

plt.xlabel("Spot Price at Maturity $S_T$ (\$)", size=15)

plt.ylabel("Probability ($\%$)", size=15)

plt.show()

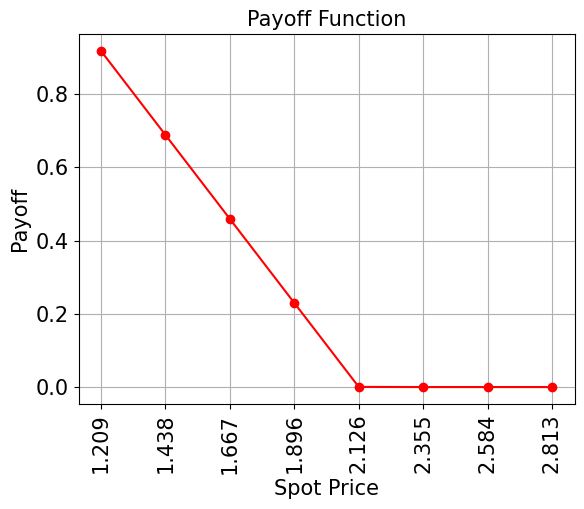

Payoff Function#

The payoff function decreases linearly with an increasing spot price at maturity \(S_T\) until it reaches zero for a spot price equal to the strike price \(K\), it stays constant to zero for larger spot prices. The implementation uses a comparator, that flips an ancilla qubit from \(\big|0\rangle\) to \(\big|1\rangle\) if \(S_T \leq K\), and this ancilla is used to control the linear part of the payoff function.

The linear part itself is then approximated as follows. We exploit the fact that \(\sin^2(y + \pi/4) \approx y + 1/2\) for small \(|y|\). Thus, for a given approximation rescaling scaling factor \(c_\text{approx} \in [0, 1]\) and \(x \in [0, 1]\) we consider

for small \(c_\text{approx}\).

We can easily construct an operator that acts as

using controlled Y-rotations.

Eventually, we are interested in the probability of measuring \(\big|1\rangle\) in the last qubit, which corresponds to \(\sin^2(a*x+b)\). Together with the approximation above, this allows to approximate the values of interest. The smaller we choose \(c_\text{approx}\), the better the approximation. However, since we are then estimating a property scaled by \(c_\text{approx}\), the number of evaluation qubits \(m\) needs to be adjusted accordingly.

For more details on the approximation, we refer to: Quantum Risk Analysis. Woerner, Egger. 2018.

[4]:

# set the strike price (should be within the low and the high value of the uncertainty)

strike_price = 2.126

# set the approximation scaling for the payoff function

rescaling_factor = 0.25

# setup piecewise linear objective fcuntion

breakpoints = [low, strike_price]

slopes = [-1, 0]

offsets = [strike_price - low, 0]

f_min = 0

f_max = strike_price - low

european_put_objective = LinearAmplitudeFunction(

num_uncertainty_qubits,

slopes,

offsets,

domain=(low, high),

image=(f_min, f_max),

breakpoints=breakpoints,

rescaling_factor=rescaling_factor,

)

# construct A operator for QAE for the payoff function by

# composing the uncertainty model and the objective

european_put = european_put_objective.compose(uncertainty_model, front=True)

[5]:

# plot exact payoff function (evaluated on the grid of the uncertainty model)

x = uncertainty_model.values

y = np.maximum(0, strike_price - x)

plt.plot(x, y, "ro-")

plt.grid()

plt.title("Payoff Function", size=15)

plt.xlabel("Spot Price", size=15)

plt.ylabel("Payoff", size=15)

plt.xticks(x, size=15, rotation=90)

plt.yticks(size=15)

plt.show()

[6]:

# evaluate exact expected value (normalized to the [0, 1] interval)

exact_value = np.dot(uncertainty_model.probabilities, y)

exact_delta = -sum(uncertainty_model.probabilities[x <= strike_price])

print("exact expected value:\t%.4f" % exact_value)

print("exact delta value: \t%.4f" % exact_delta)

exact expected value: 0.1709

exact delta value: -0.8193

Evaluate Expected Payoff#

[7]:

# set target precision and confidence level

epsilon = 0.01

alpha = 0.05

problem = EstimationProblem(

state_preparation=european_put,

objective_qubits=[num_uncertainty_qubits],

post_processing=european_put_objective.post_processing,

)

# construct amplitude estimation

ae = IterativeAmplitudeEstimation(

epsilon_target=epsilon, alpha=alpha, sampler=Sampler(run_options={"shots": 100, "seed": 75})

)

[8]:

result = ae.estimate(problem)

[9]:

conf_int = np.array(result.confidence_interval_processed)

print("Exact value: \t%.4f" % exact_value)

print("Estimated value: \t%.4f" % (result.estimation_processed))

print("Confidence interval:\t[%.4f, %.4f]" % tuple(conf_int))

Exact value: 0.1709

Estimated value: 0.1770

Confidence interval: [0.1720, 0.1820]

Evaluate Delta#

The Delta is a bit simpler to evaluate than the expected payoff. Similarly to the expected payoff, we use a comparator circuit and an ancilla qubit to identify the cases where \(S_T \leq K\). However, since we are only interested in the (negative) probability of this condition being true, we can directly use this ancilla qubit as the objective qubit in amplitude estimation without any further approximation.

[10]:

# setup piecewise linear objective fcuntion

breakpoints = [low, strike_price]

slopes = [0, 0]

offsets = [1, 0]

f_min = 0

f_max = 1

european_put_delta_objective = LinearAmplitudeFunction(

num_uncertainty_qubits,

slopes,

offsets,

domain=(low, high),

image=(f_min, f_max),

breakpoints=breakpoints,

)

# construct circuit for payoff function

european_put_delta = european_put_delta_objective.compose(uncertainty_model, front=True)

[11]:

# set target precision and confidence level

epsilon = 0.01

alpha = 0.05

problem = EstimationProblem(

state_preparation=european_put_delta, objective_qubits=[num_uncertainty_qubits]

)

# construct amplitude estimation

ae_delta = IterativeAmplitudeEstimation(

epsilon_target=epsilon, alpha=alpha, sampler=Sampler(run_options={"shots": 100, "seed": 75})

)

[12]:

result_delta = ae_delta.estimate(problem)

[13]:

conf_int = -np.array(result_delta.confidence_interval)[::-1]

print("Exact delta: \t%.4f" % exact_delta)

print("Estimated value: \t%.4f" % -result_delta.estimation)

print("Confidence interval: \t[%.4f, %.4f]" % tuple(conf_int))

Exact delta: -0.8193

Estimated value: -0.8197

Confidence interval: [-0.8236, -0.8158]

[14]:

import tutorial_magics

%qiskit_version_table

%qiskit_copyright

Version Information

| Software | Version |

|---|---|

qiskit | 1.0.1 |

qiskit_algorithms | 0.3.0 |

qiskit_aer | 0.13.3 |

qiskit_finance | 0.4.1 |

| System information | |

| Python version | 3.8.18 |

| OS | Linux |

| Thu Feb 29 03:06:21 2024 UTC | |

This code is a part of a Qiskit project

© Copyright IBM 2017, 2024.

This code is licensed under the Apache License, Version 2.0. You may

obtain a copy of this license in the LICENSE.txt file in the root directory

of this source tree or at http://www.apache.org/licenses/LICENSE-2.0.

Any modifications or derivative works of this code must retain this

copyright notice, and modified files need to carry a notice indicating

that they have been altered from the originals.

[ ]: