Note

This page was generated from docs/tutorials/07_asian_barrier_spread_pricing.ipynb.

Pricing Asian Barrier Spreads#

Introduction#

An Asian barrier spread is a combination of 3 different option types, and as such, combines multiple possible features that the Qiskit Finance option pricing framework supports:

Asian option: The payoff depends on the average price over the considered time horizon.

Barrier Option: The payoff is zero if a certain threshold is exceeded at any time within the considered time horizon.

(Bull) Spread: The payoff follows a piecewise linear function (depending on the average price) starting at zero, increasing linear, staying constant.

Suppose strike prices \(K_1 < K_2\) and time periods \(t=1,2\), with corresponding spot prices \((S_1, S_2)\) following a given multivariate distribution (e.g. generated by some stochastic process), and a barrier threshold \(B>0\). The corresponding payoff function is defined as

In the following, a quantum algorithm based on amplitude estimation is used to estimate the expected payoff, i.e., the fair price before discounting, for the option

The approximation of the objective function and a general introduction to option pricing and risk analysis on quantum computers are given in the following papers:

[1]:

import matplotlib.pyplot as plt

from scipy.interpolate import griddata

%matplotlib inline

import numpy as np

from qiskit import QuantumRegister, QuantumCircuit, AncillaRegister, transpile

from qiskit.circuit.library import IntegerComparator, WeightedAdder, LinearAmplitudeFunction

from qiskit_algorithms import IterativeAmplitudeEstimation, EstimationProblem

from qiskit_aer.primitives import Sampler

from qiskit_finance.circuit.library import LogNormalDistribution

Uncertainty Model#

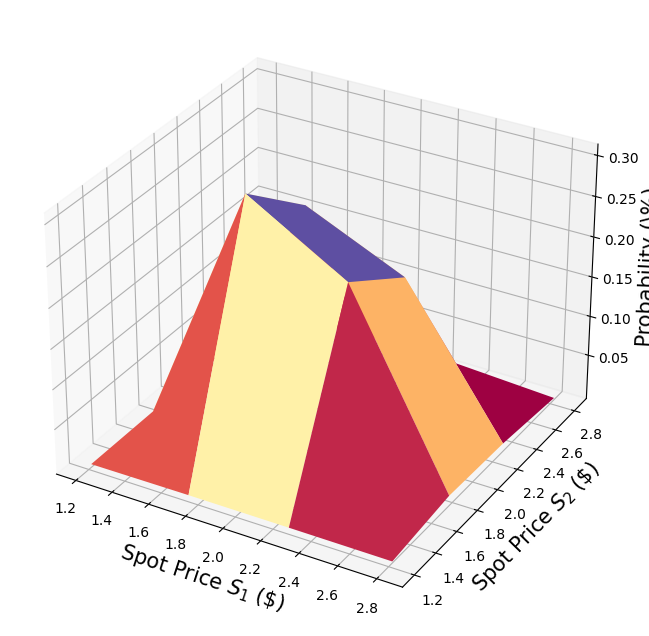

We construct a circuit to load a multivariate log-normal random distribution into a quantum state on \(n\) qubits. For every dimension \(j = 1,\ldots,d\), the distribution is truncated to a given interval \([\text{low}_j, \text{high}_j]\) and discretized using \(2^{n_j}\) grid points, where \(n_j\) denotes the number of qubits used to represent dimension \(j\), i.e., \(n_1+\ldots+n_d = n\). The unitary operator corresponding to the circuit implements the following:

where \(p_{i_1\ldots i_d}\) denote the probabilities corresponding to the truncated and discretized distribution and where \(i_j\) is mapped to the right interval using the affine map:

For simplicity, we assume both stock prices are independent and identically distributed. This assumption just simplifies the parametrization below and can be easily relaxed to more complex and also correlated multivariate distributions. The only important assumption for the current implementation is that the discretization grid of the different dimensions has the same step size.

[2]:

# number of qubits per dimension to represent the uncertainty

num_uncertainty_qubits = 2

# parameters for considered random distribution

S = 2.0 # initial spot price

vol = 0.4 # volatility of 40%

r = 0.05 # annual interest rate of 4%

T = 40 / 365 # 40 days to maturity

# resulting parameters for log-normal distribution

mu = (r - 0.5 * vol**2) * T + np.log(S)

sigma = vol * np.sqrt(T)

mean = np.exp(mu + sigma**2 / 2)

variance = (np.exp(sigma**2) - 1) * np.exp(2 * mu + sigma**2)

stddev = np.sqrt(variance)

# lowest and highest value considered for the spot price; in between, an equidistant discretization is considered.

low = np.maximum(0, mean - 3 * stddev)

high = mean + 3 * stddev

# map to higher dimensional distribution

# for simplicity assuming dimensions are independent and identically distributed)

dimension = 2

num_qubits = [num_uncertainty_qubits] * dimension

low = low * np.ones(dimension)

high = high * np.ones(dimension)

mu = mu * np.ones(dimension)

cov = sigma**2 * np.eye(dimension)

# construct circuit

u = LogNormalDistribution(num_qubits=num_qubits, mu=mu, sigma=cov, bounds=(list(zip(low, high))))

[3]:

# plot PDF of uncertainty model

x = [v[0] for v in u.values]

y = [v[1] for v in u.values]

z = u.probabilities

# z = map(float, z)

# z = list(map(float, z))

resolution = np.array([2**n for n in num_qubits]) * 1j

grid_x, grid_y = np.mgrid[min(x) : max(x) : resolution[0], min(y) : max(y) : resolution[1]]

grid_z = griddata((x, y), z, (grid_x, grid_y))

plt.figure(figsize=(10, 8))

ax = plt.axes(projection="3d")

ax.plot_surface(grid_x, grid_y, grid_z, cmap=plt.cm.Spectral)

ax.set_xlabel("Spot Price $S_1$ (\$)", size=15)

ax.set_ylabel("Spot Price $S_2$ (\$)", size=15)

ax.set_zlabel("Probability (\%)", size=15)

plt.show()

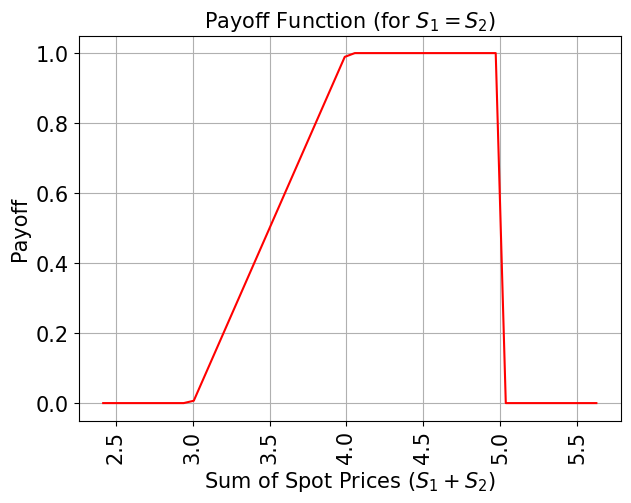

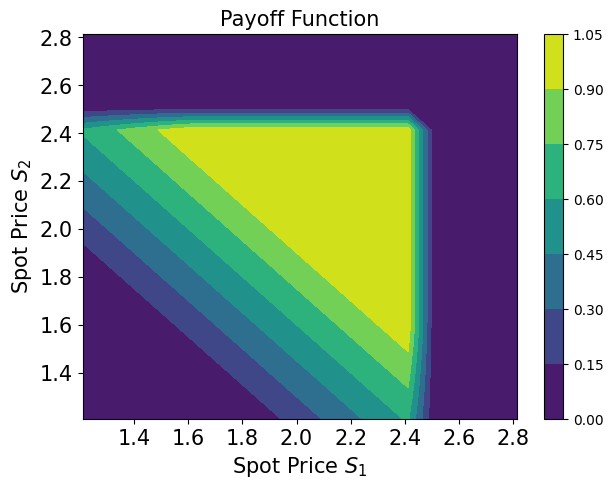

Payoff Function#

For simplicity, we consider the sum of the spot prices instead of their average. The result can be transformed to the average by just dividing it by 2.

The payoff function equals zero as long as the sum of the spot prices \((S_1 + S_2)\) is less than the strike price \(K_1\) and then increases linearly until the sum of the spot prices reaches \(K_2\). Then payoff stays constant to \(K_2 - K_1\) unless any of the two spot prices exceeds the barrier threshold \(B\), then the payoff goes immediately down to zero. The implementation first uses a weighted sum operator to compute the sum of the spot prices into an ancilla register, and then uses a comparator, that flips an ancilla qubit from \(\big|0\rangle\) to \(\big|1\rangle\) if \((S_1 + S_2) \geq K_1\) and another comparator/ancilla to capture the case that \((S_1 + S_2) \geq K_2\). These ancillas are used to control the linear part of the payoff function.

In addition, we add another ancilla variable for each time step and use additional comparators to check whether \(S_1\), respectively \(S_2\), exceed the barrier threshold \(B\). The payoff function is only applied if \(S_1, S_2 \leq B\).

The linear part itself is approximated as follows. We exploit the fact that \(\sin^2(y + \pi/4) \approx y + 1/2\) for small \(|y|\). Thus, for a given approximation scaling factor \(c_\text{approx} \in [0, 1]\) and \(x \in [0, 1]\) we consider

for small \(c_\text{approx}\).

We can easily construct an operator that acts as

using controlled Y-rotations.

Eventually, we are interested in the probability of measuring \(\big|1\rangle\) in the last qubit, which corresponds to \(\sin^2(a*x+b)\). Together with the approximation above, this allows to approximate the values of interest. The smaller we choose \(c_\text{approx}\), the better the approximation. However, since we are then estimating a property scaled by \(c_\text{approx}\), the number of evaluation qubits \(m\) needs to be adjusted accordingly.

For more details on the approximation, we refer to: Quantum Risk Analysis. Woerner, Egger. 2018.

Since the weighted sum operator (in its current implementation) can only sum up integers, we need to map from the original ranges to the representable range to estimate the result, and reverse this mapping before interpreting the result. The mapping essentially corresponds to the affine mapping described in the context of the uncertainty model above.

[4]:

# determine number of qubits required to represent total loss

weights = []

for n in num_qubits:

for i in range(n):

weights += [2**i]

# create aggregation circuit

agg = WeightedAdder(sum(num_qubits), weights)

n_s = agg.num_sum_qubits

n_aux = agg.num_qubits - n_s - agg.num_state_qubits # number of additional qubits

[5]:

# set the strike price (should be within the low and the high value of the uncertainty)

strike_price_1 = 3

strike_price_2 = 4

# set the barrier threshold

barrier = 2.5

# map strike prices and barrier threshold from [low, high] to {0, ..., 2^n-1}

max_value = 2**n_s - 1

low_ = low[0]

high_ = high[0]

mapped_strike_price_1 = (

(strike_price_1 - dimension * low_) / (high_ - low_) * (2**num_uncertainty_qubits - 1)

)

mapped_strike_price_2 = (

(strike_price_2 - dimension * low_) / (high_ - low_) * (2**num_uncertainty_qubits - 1)

)

mapped_barrier = (barrier - low) / (high - low) * (2**num_uncertainty_qubits - 1)

[6]:

# condition and condition result

conditions = []

barrier_thresholds = [2] * dimension

n_aux_conditions = 0

for i in range(dimension):

# target dimension of random distribution and corresponding condition (which is required to be True)

comparator = IntegerComparator(num_qubits[i], mapped_barrier[i] + 1, geq=False)

n_aux_conditions = max(n_aux_conditions, comparator.num_ancillas)

conditions += [comparator]

[7]:

# set the approximation scaling for the payoff function

c_approx = 0.25

# setup piecewise linear objective fcuntion

breakpoints = [0, mapped_strike_price_1, mapped_strike_price_2]

slopes = [0, 1, 0]

offsets = [0, 0, mapped_strike_price_2 - mapped_strike_price_1]

f_min = 0

f_max = mapped_strike_price_2 - mapped_strike_price_1

objective = LinearAmplitudeFunction(

n_s,

slopes,

offsets,

domain=(0, max_value),

image=(f_min, f_max),

rescaling_factor=c_approx,

breakpoints=breakpoints,

)

[8]:

# define overall multivariate problem

qr_state = QuantumRegister(u.num_qubits, "state") # to load the probability distribution

qr_obj = QuantumRegister(1, "obj") # to encode the function values

ar_sum = AncillaRegister(n_s, "sum") # number of qubits used to encode the sum

ar_cond = AncillaRegister(len(conditions) + 1, "conditions")

ar = AncillaRegister(

max(n_aux, n_aux_conditions, objective.num_ancillas), "work"

) # additional qubits

objective_index = u.num_qubits

# define the circuit

asian_barrier_spread = QuantumCircuit(qr_state, qr_obj, ar_cond, ar_sum, ar)

# load the probability distribution

asian_barrier_spread.append(u, qr_state)

# apply the conditions

for i, cond in enumerate(conditions):

state_qubits = qr_state[(num_uncertainty_qubits * i) : (num_uncertainty_qubits * (i + 1))]

asian_barrier_spread.append(cond, state_qubits + [ar_cond[i]] + ar[: cond.num_ancillas])

# aggregate the conditions on a single qubit

asian_barrier_spread.mcx(ar_cond[:-1], ar_cond[-1])

# apply the aggregation function controlled on the condition

asian_barrier_spread.append(agg.control(), [ar_cond[-1]] + qr_state[:] + ar_sum[:] + ar[:n_aux])

# apply the payoff function

asian_barrier_spread.append(objective, ar_sum[:] + qr_obj[:] + ar[: objective.num_ancillas])

# uncompute the aggregation

asian_barrier_spread.append(

agg.inverse().control(), [ar_cond[-1]] + qr_state[:] + ar_sum[:] + ar[:n_aux]

)

# uncompute the conditions

asian_barrier_spread.mcx(ar_cond[:-1], ar_cond[-1])

for j, cond in enumerate(reversed(conditions)):

i = len(conditions) - j - 1

state_qubits = qr_state[(num_uncertainty_qubits * i) : (num_uncertainty_qubits * (i + 1))]

asian_barrier_spread.append(

cond.inverse(), state_qubits + [ar_cond[i]] + ar[: cond.num_ancillas]

)

print(asian_barrier_spread.draw())

print("objective qubit index", objective_index)

┌───────┐┌──────┐ ┌───────────┐ ┌──────────────┐»

state_0: ┤0 ├┤0 ├─────────────┤1 ├──────┤1 ├»

│ ││ │ │ │ │ │»

state_1: ┤1 ├┤1 ├─────────────┤2 ├──────┤2 ├»

│ P(X) ││ │┌──────┐ │ │ │ │»

state_2: ┤2 ├┤ ├┤0 ├─────┤3 ├──────┤3 ├»

│ ││ ││ │ │ │ │ │»

state_3: ┤3 ├┤ ├┤1 ├─────┤4 ├──────┤4 ├»

└───────┘│ ││ │ │ │┌────┐│ │»

obj: ─────────┤ ├┤ ├─────┤ ├┤3 ├┤ ├»

│ ││ │ │ ││ ││ │»

conditions_0: ─────────┤2 ├┤ ├──■──┤ ├┤ ├┤ ├»

│ cmp ││ │ │ │ ││ ││ │»

conditions_1: ─────────┤ ├┤2 ├──■──┤ ├┤ ├┤ ├»

│ ││ cmp │┌─┴─┐│ c_adder ││ ││ c_adder_dg │»

conditions_2: ─────────┤ ├┤ ├┤ X ├┤0 ├┤ ├┤0 ├»

│ ││ │└───┘│ ││ ││ │»

sum_0: ─────────┤ ├┤ ├─────┤5 ├┤0 ├┤5 ├»

│ ││ │ │ ││ F ││ │»

sum_1: ─────────┤ ├┤ ├─────┤6 ├┤1 ├┤6 ├»

│ ││ │ │ ││ ││ │»

sum_2: ─────────┤ ├┤ ├─────┤7 ├┤2 ├┤7 ├»

│ ││ │ │ ││ ││ │»

work_0: ─────────┤3 ├┤3 ├─────┤8 ├┤4 ├┤8 ├»

└──────┘└──────┘ │ ││ ││ │»

work_1: ──────────────────────────────┤9 ├┤5 ├┤9 ├»

│ ││ ││ │»

work_2: ──────────────────────────────┤10 ├┤6 ├┤10 ├»

└───────────┘└────┘└──────────────┘»

« ┌─────────┐

« state_0: ────────────────┤0 ├

« │ │

« state_1: ────────────────┤1 ├

« ┌─────────┐│ │

« state_2: ─────┤0 ├┤ ├

« │ ││ │

« state_3: ─────┤1 ├┤ ├

« │ ││ │

« obj: ─────┤ ├┤ ├

« │ ││ │

«conditions_0: ──■──┤ ├┤2 ├

« │ │ ││ cmp_dg │

«conditions_1: ──■──┤2 ├┤ ├

« ┌─┴─┐│ cmp_dg ││ │

«conditions_2: ┤ X ├┤ ├┤ ├

« └───┘│ ││ │

« sum_0: ─────┤ ├┤ ├

« │ ││ │

« sum_1: ─────┤ ├┤ ├

« │ ││ │

« sum_2: ─────┤ ├┤ ├

« │ ││ │

« work_0: ─────┤3 ├┤3 ├

« └─────────┘└─────────┘

« work_1: ───────────────────────────

«

« work_2: ───────────────────────────

«

objective qubit index 4

[9]:

# plot exact payoff function

plt.figure(figsize=(7, 5))

x = np.linspace(sum(low), sum(high))

y = (x <= 5) * np.minimum(np.maximum(0, x - strike_price_1), strike_price_2 - strike_price_1)

plt.plot(x, y, "r-")

plt.grid()

plt.title("Payoff Function (for $S_1 = S_2$)", size=15)

plt.xlabel("Sum of Spot Prices ($S_1 + S_2)$", size=15)

plt.ylabel("Payoff", size=15)

plt.xticks(size=15, rotation=90)

plt.yticks(size=15)

plt.show()

[10]:

# plot contour of payoff function with respect to both time steps, including barrier

plt.figure(figsize=(7, 5))

z = np.zeros((17, 17))

x = np.linspace(low[0], high[0], 17)

y = np.linspace(low[1], high[1], 17)

for i, x_ in enumerate(x):

for j, y_ in enumerate(y):

z[i, j] = np.minimum(

np.maximum(0, x_ + y_ - strike_price_1), strike_price_2 - strike_price_1

)

if x_ > barrier or y_ > barrier:

z[i, j] = 0

plt.title("Payoff Function", size=15)

plt.contourf(x, y, z)

plt.colorbar()

plt.xlabel("Spot Price $S_1$", size=15)

plt.ylabel("Spot Price $S_2$", size=15)

plt.xticks(size=15)

plt.yticks(size=15)

plt.show()

[11]:

# evaluate exact expected value

sum_values = np.sum(u.values, axis=1)

payoff = np.minimum(np.maximum(sum_values - strike_price_1, 0), strike_price_2 - strike_price_1)

leq_barrier = [np.max(v) <= barrier for v in u.values]

exact_value = np.dot(u.probabilities[leq_barrier], payoff[leq_barrier])

print("exact expected value:\t%.4f" % exact_value)

exact expected value: 0.8023

Evaluate Expected Payoff#

We first verify the quantum circuit by simulating it and analyzing the resulting probability to measure the \(|1\rangle\) state in the objective qubit.

[12]:

num_state_qubits = asian_barrier_spread.num_qubits - asian_barrier_spread.num_ancillas

print("state qubits: ", num_state_qubits)

transpiled = transpile(asian_barrier_spread, basis_gates=["u", "cx"])

print("circuit width:", transpiled.width())

print("circuit depth:", transpiled.depth())

state qubits: 5

circuit width: 14

circuit depth: 6045

[13]:

asian_barrier_spread_measure = asian_barrier_spread.measure_all(inplace=False)

sampler = Sampler()

job = sampler.run(asian_barrier_spread_measure)

[14]:

# evaluate the result

value = 0

probabilities = job.result().quasi_dists[0].binary_probabilities()

for i, prob in probabilities.items():

if prob > 1e-4 and i[-num_state_qubits:][0] == "1":

value += prob

# map value to original range

mapped_value = objective.post_processing(value) / (2**num_uncertainty_qubits - 1) * (high_ - low_)

print("Exact Operator Value: %.4f" % value)

print("Mapped Operator value: %.4f" % mapped_value)

print("Exact Expected Payoff: %.4f" % exact_value)

Exact Operator Value: 0.6221

Mapped Operator value: 0.8108

Exact Expected Payoff: 0.8023

Next we use amplitude estimation to estimate the expected payoff. Note that this can take a while since we are simulating a large number of qubits. The way we designed the operator (asian_barrier_spread) implies that the number of actual state qubits is significantly smaller, thus, helping to reduce the overall simulation time a bit.

[15]:

# set target precision and confidence level

epsilon = 0.01

alpha = 0.05

problem = EstimationProblem(

state_preparation=asian_barrier_spread,

objective_qubits=[objective_index],

post_processing=objective.post_processing,

)

# construct amplitude estimation

ae = IterativeAmplitudeEstimation(

epsilon, alpha=alpha, sampler=Sampler(run_options={"shots": 100, "seed": 75})

)

[16]:

result = ae.estimate(problem)

[17]:

conf_int = (

np.array(result.confidence_interval_processed)

/ (2**num_uncertainty_qubits - 1)

* (high_ - low_)

)

print("Exact value: \t%.4f" % exact_value)

print(

"Estimated value:\t%.4f"

% (result.estimation_processed / (2**num_uncertainty_qubits - 1) * (high_ - low_))

)

print("Confidence interval: \t[%.4f, %.4f]" % tuple(conf_int))

Exact value: 0.8023

Estimated value: 0.8320

Confidence interval: [0.8264, 0.8376]

[18]:

import tutorial_magics

%qiskit_version_table

%qiskit_copyright

Version Information

| Software | Version |

|---|---|

qiskit | 1.0.1 |

qiskit_algorithms | 0.3.0 |

qiskit_aer | 0.13.3 |

qiskit_finance | 0.4.1 |

| System information | |

| Python version | 3.8.18 |

| OS | Linux |

| Thu Feb 29 03:07:17 2024 UTC | |

This code is a part of a Qiskit project

© Copyright IBM 2017, 2024.

This code is licensed under the Apache License, Version 2.0. You may

obtain a copy of this license in the LICENSE.txt file in the root directory

of this source tree or at http://www.apache.org/licenses/LICENSE-2.0.

Any modifications or derivative works of this code must retain this

copyright notice, and modified files need to carry a notice indicating

that they have been altered from the originals.

[ ]: